What Is Bank Nifty & How To Trade In Bank Nifty : If you work in the stock market then you must have heard of Bank Nifty. In today’s article, what is Bank Nifty / How to trade in Bank Nifty? In this article we will understand Bank Nifty in detail and know what Bank Nifty is, why it is needed, how it works, which banks’ shares are included in this index, and we will know everything in great detail.

What Is Bank Nifty | Bank Nifty Meaning

Bank Nifty is an index consisting of 12 trusted banking stocks which reflects the banking growth of India. Just as Sensex is the index of shares of 30 big companies of Bombay Stock Exchange and Nifty 50 is the index of 50 big and trusted shares of National Stock Exchange, similarly Nifty is made up of shares of 12 trusted banks of NSE (National Stock Exchange). Bank index has been created.

If there is good growth in the banks of the banking sector and they are earning good profits then the shares of the banking companies will go up. If banking shares go up then Bank Nifty index will also go up rapidly. Similarly, when there is a recession in the banking sector, then this index also does not perform well. The symbol of Bank Nifty is NSEBANK.

This index represents the banking growth of India. There is a lot of volatility in the Bank Nifty index, that is why traders trading in Future and Option (F&O) of the stock market prefer Nifty Bank more. Traders trading in the stock market prefer such indices or shares which have high volatility.

Why Was There Need For A Bank Nifty?

Companies from many sectors are listed in the stock market. Some sectors are so big that there are many companies in those sectors, like IT sector, banking sector, media sector etc. To know the growth of the sector of companies operating in the stock market, an index of that sector was created by combining some reliable companies of that sector.

In this sequence, Bank Nifty Index was started by IISL (Indian Intex Service Products Limited) in the year 2000. 12 reliable government and private banks operating in India have been included in this index. This index is reviewed after every 6 months. If a bank does not fulfil the conditions for inclusion in this index, then it is excluded and the bank that fulfils the conditions is included.

Conditions For Joining Bank Nifty

All the indices made in the stock market are reviewed every 6 months. If any company does not fulfil the conditions of the index, then it is excluded and the company that fulfils the conditions is included in the index. Similarly, the Bank Nifty index is reviewed every 6 months. If a bank does not fulfil the conditions for inclusion in this index, then it is excluded and the bank that fulfils the conditions is included.

The conditions for joining Nifty Bank are as follows:-

- To join Bank Nifty, the bank must be Indian.

- The headquarter and branch of the bank must be in India.

- It is necessary for the bank to be in the market cap top 12.

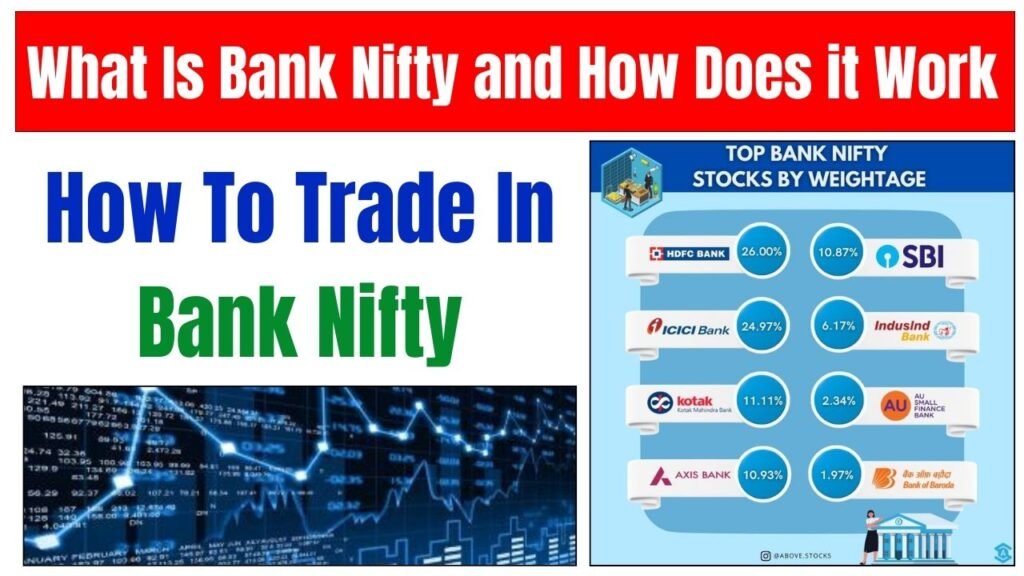

Banks Included In Bank Nifty

Currently the banks included in the Bank Nifty index are as follows:-

| Sl No. | Company | NSE Symbol | Weightage |

| 1 | HDFC BANK LTD | HDFCBANK | 33.65% |

| 2 | ICICI BANK LTD | ICICIBANK | 18.33% |

| 3 | STATE BANK OF INDIA | SBIN | 15.10% |

| 4 | KOTAK MAHINDRA BANK LTD | KOTAKBANK | 9.92% |

| 5 | AXIS BANK LTD | AXISBANK | 8.88% |

| 6 | INDUSIND BANK LTD | INDUSINDBK | 3.26% |

| 7 | BANK OF BARODA | BANKBARODA | 3.13% |

| 8 | PUNJAB NATIONAL BANK | PNB | 2.74% |

| 9 | IDFC FIRST BANK LTD | IDFCFIRSTB | 1.63% |

| 10 | AU SMALL FINANCE BANK LTD | AUBANK | 1.37% |

| 11 | BANDHAN BANK LTD | BANDHANBNK | 1.00% |

| 12 | THE FEDERAL BANK LTD | FEDERALBNK | 0.98% |

These 12 banks represent Nifty Bank. When there is a boom in these banks, Nifty Bank goes up and when there is a recession, Nifty Bank goes down. Traders trading in Bank Nifty look at the charts of Nifty Bank along with the charts of HDFC BANK LTD and ICICI BANK LTD because these two banks have more than half the weightage in Nifty Bank.

The weightage of banks included in Nifty Bank depends on their market cap. The higher the market capitalization of a bank, the more weightage it has in the index. When the market cap of a bank goes up rapidly, then the weightage of that bank in Nifty Bank also increases.

How To Trade In Bank Nifty?

70 to 80 % of the traders trading in the stock market try to earn profit by trading in Nifty Bank. The reason for this is the volatility of Bank Nifty. Due to high volatility in Nifty Bank, this index fluctuates a lot. Since traders need to square off their positions quickly, they prefer more volatile indices or stocks.

If you also want to trade in Nifty Bank, then you can trade in two ways. The first way is to trade in F&O and the second way is to trade in Intraday. Traders who trade in Futures and Options (F&O) of Bank Nifty buy the Bank Nifty index and hold it for a few days and book profit or loss as per their analysis as time passes.

Some traders do intraday trading in Nifty Bank. They square off their positions before 3:30 pm on the same day they create positions in Bank Nifty options. A trader trading in Bank Nifty has nothing to do with the fundamentals of any company. Traders take trades only by doing technical analysis and earn profits.

If you are new to the world of stock market and you want to learn how to trade in the stock market, then you must read the article How to Learn Trading. Apart from this, you should start your trading with less capital. By doing this you will be able to earn both learning and earning with less capital.

Lot Size Of Bank Nifty

At present the price of Nifty Bank index is hovering around 48000. If you try to trade by buying this Nifty Bank directly, then you will need a lot of capital. Therefore, to make trading easier in Nifty Bank, Futures and Options (F&O) were invented.

In this, Nifty Bank has been made contract based so that instead of paying the full price of the index, you have to pay the premium of that option, which keeps changing with time and the price of Nifty Bank index. If you want to understand F&O better then you will have to study Option Chain Analysis in detail.

Traders who trade in Bank Nifty buy the option of Nifty Bank. Buying and selling of Nifty Bank options is done in lots. Earlier, there was a quantity of 25 in one lot of Nifty Bank option. But now keeping in mind the market volatility, the quantity in one lot has been reduced to 15 instead of 25.