Tata Technologies Limited IPO Full Details : In last few days various companies are bringing their IPO. In this series Tata Technologies Limited are coming up with their IPO. These IPO was the fifth IPO of these month.

In today’s article we will learn Tata Technologies Limited IPO in detail. So , in today’s article we will learn what works are performed by these companies, when these companies will bring their IPO, what is the financial condition of this company. Along with these we will also think whether you should invest in these companies or not.

History Of Tata Technologies Limited Company

The Tata Technologies company was founded in 1989, 33 years ago, and is based in Pune. This business operates in 25 nations, including India. More than 11,000 workers from 25 different nations make up the company.After nearly 19 years, the Tata Group is finally bringing one of its affiliated enterprises to market. The Tata Group had brought TCS’s IPO earlier in 2004.

When Was The Application Given To SEBI

On March 9, 2023, Tata Technologies, a division of Tata Motors, filed its DHRP, or Draft Red Herring Prospectus, with the market regulator SEBI in preparation for the company’s initial public offering.

What Does Tata Technologies Company Do ?

It is a division of Tata Motors, a company that works in the aerospace and automotive industries. In addition, the company works in manufacturing, digital services, global product engineering, software product design, engineering, and education.

How to Become Millionaire By Investing Rupees 2500 Per Month

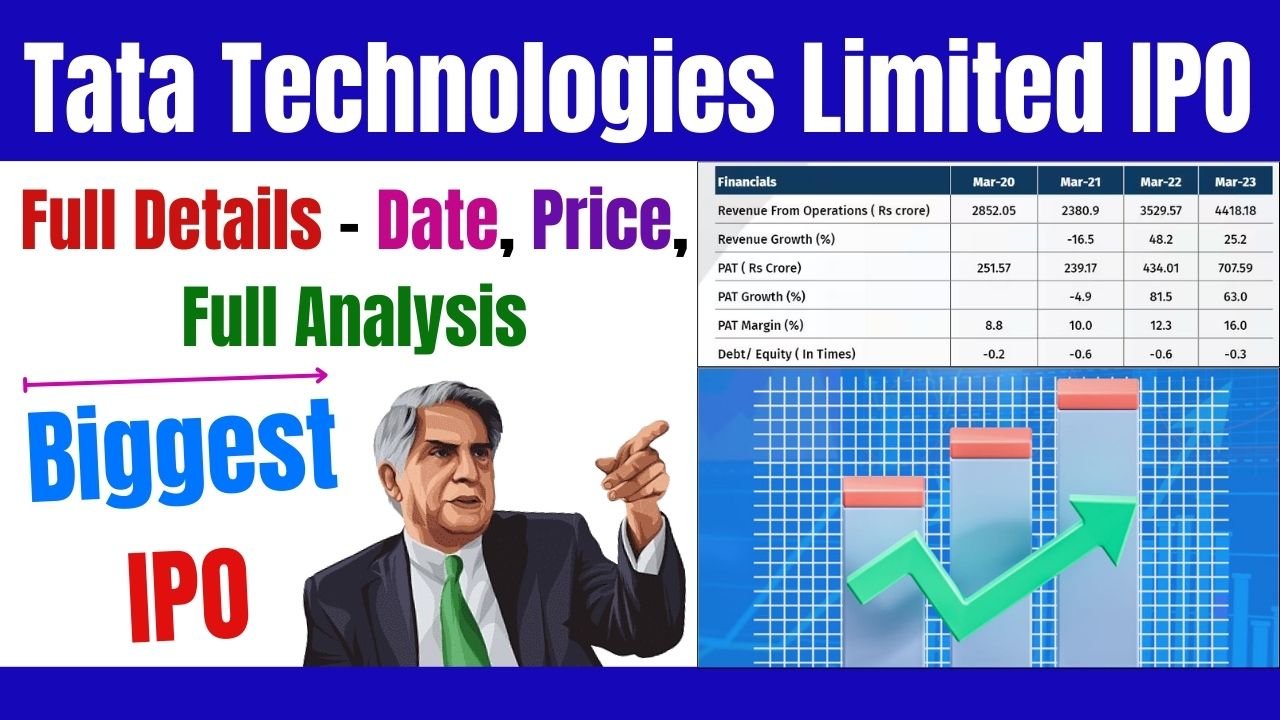

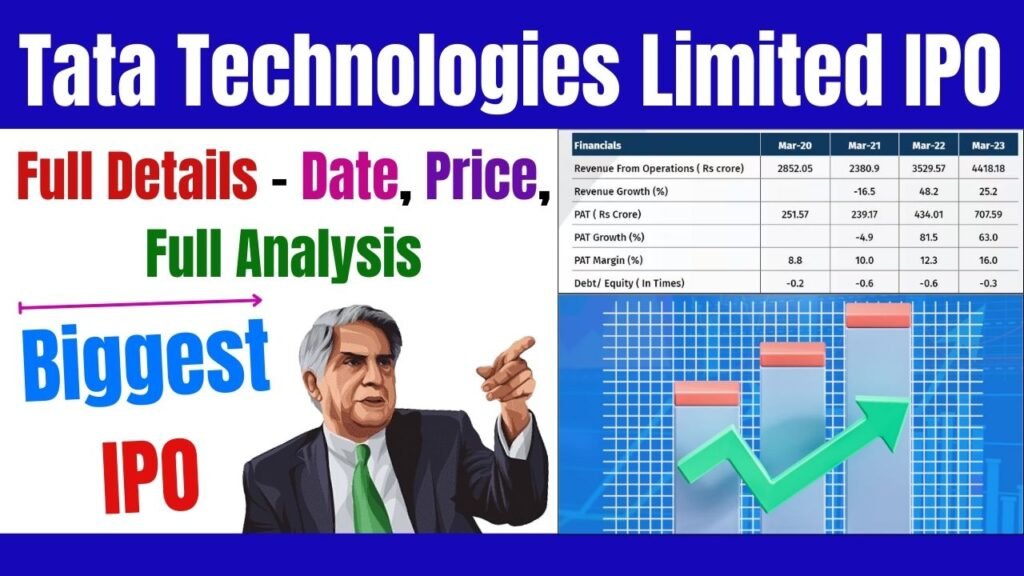

Financial Position Of The Company

During the first three quarters of the 2022–2023 fiscal year, the company brought in Rs 3011.8 crore in revenue (15.5% yearly growth), with profits at Rs 407.5 crore. In the upcoming quarter, the business will unveil the final financial year 2022–2023 results.,

| Description | 30 Sep 2023 | 31 Mar 2023 | 31 Mar 2022 |

| Assets | 5,142.42 | 5,201.49 | 4,218.00 |

| Revenue | 2,587.42 | 4,501.93 | 3,578.38 |

| Profit After Tax | 351.90 | 624.04 | 436.99 |

| OPM | 19% | 18% | |

| Net Worth | 2,853.13 | 2,989.47 | 2,280.16 |

| Reserves and Surplus | 2,455.29 | 2,605.60 | 2,028.93 |

Tata Technologies IPO Lot Size

The IPO’s price range for the company is ₹475–₹500. Thus, in order to participate in the company’s initial public offering (IPO), you must submit an application and place a bid between Rs. 475 and Rs. 500. A single lot of the corporation consists of thirty shares. As a result, the retail investor must invest in the upper price band with a minimum of 30×500 = 15,000.

Timeline Of Tata Technologies Limited IPO

The initial public offering (IPO) of Tata Technologies Limited is scheduled to commence on Wednesday, November 22, 2023, and run through Friday, November 24, 2023. On December 5, 2023, Tata Technologies Limited’s shares will go public.

Structure of Tata Technologies Limited IPO

The remaining part, or 10%, is designated for retail investors like you and us. The remaining 75% of the total share is designated for QIBs (Qualified Institutional Buyers), 15% for NIIs (Non-Institutional Investors). This is readily understood from the table that follows:-

| Serial Number | Investor | Assigned Shares |

| 1 | Offered QIB (Qualified Institutional Buyers) | 50% of the total issue |

| 2 | Shares Earmarked for NII (Non Institutional Investors) | 15% of the total issue |

| 3 | Shares Earmarked for Retail Investors | 35% of the total issue |

Grey Market Premium Of Tata Technologies Limited

A company’s grey market begins trading five to six days before to the opening of the IPO. As long as there remain shares in the corporation, trade will continue. The market does not have the share listed. A major factor influencing the GMP of an IPO is market sentiment and IPO subscription. In the event of a favourable market mood, the company’s IPO’s GPM rises; conversely, a negative market attitude causes the GMP to decrease.

On November 22, 2023, Tata Technologies Limited will launch its initial public offering (IPO); nevertheless, the business is now trading at a significant premium in the secondary market. The company’s IPO is currently trading in the grey market at a premium of Rs 403 as of today, November 19, 2023.

If interpreted appropriately, the company’s shares might be listed at a premium of around 80% on the stock market, at about Rs 903. On December 5, 2023, at 10 a.m., if all goes according to plan, the company’s shares will begin trading on the stock market.

Key Facts of Tata Technologies Limited IPO

- These company IPO will open on 22, November,2023 and close on 24, November, 2023.

- The price band of these company IPO will be between Rs475 to 500.

- The listing of these company IPO will be held on 5, December,2023.

- Through the IPO, the corporation is attempting to sell shares valued at Rs 3,042.51 crore in an effort to lower its stake.

- These company IPO will be listed on both BSE and NSE.

- The face vale of share of this company will be Rs2

Should I apply For Tata Technologies Limited IPO or Not ?

The company Tata Technologies Limited is still rather small. The business has enormous growth potential. In the most recent fiscal year, the company’s revenue increased by almost 26%. From the perspective of investors, the company is starting its IPO with a PE of 32.53, which is appropriate.

Selling shares after the IPO is allotted is one way to earn a profit if you are applying for listing gain in the company’s IPO. However, if you applied for the IPO after observing the company’s growth, you will be able to benefit from that growth by making a long-term investment.