10 Mistakes of Stock Market : My dear readers, today in this article of 10 mistakes of stock market, we will understand in detail about those mistakes of stock market which a new trader or investor often mix. The stock market gives making the trader or investor who does not correct this mistakes poor until they correct this mistakes.

Who doesn’t want to earn money? Everyone wants to earn money and most people want to earn money fast. Will there are many ways to earn money fast. One of the best way to earn money fast is to earn money from the stock market.

Share market is such a sea of money from which you can withdraw as much money as you want but justly of money is never going to end. There are some rules for withdrawing money from the share market following which you can withdraw money from the share market. But if you make the mistake of not following this rules then the sea of money will swellow your money and you will be left with nothing except regrets.

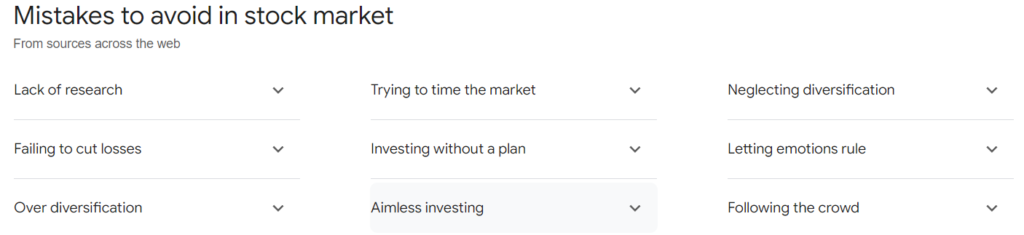

10 Mistakes of Stock Market | Investing Mistakes to Avoid

Today I will share my experience of the last 5 years with you and tell you about the mistakes I have made. I don’t want you to repeat the mistakes made by the because when I came into the market there were not enough means of study in the market. But now there is a lot of information available on the internet.

When a person steps into the stock market for the first time he makes mistakes but only that person is successful in earning money from the market who does not repeat his mistake again and again. The trader who thinks it deadly and correct his mistakes once he incurrs a loss plays in crores.

Not Doing Fundamental Analysis of the Invested Company

Not doing fundamental analysis of the chart is at the first place among the 10 mistakes of the stock market. Before investing in any company you should do fundamental analysis of that company throughly.

By doing fundamental analysis of a company you are able to know whether a company is worth investing / trading or not. In fundamental analysis of a company one examines the following parameters of the company:-

● Cash Flow Statement

● Read the companies annual report.

● Profit loss statement.

● Understand the companies business model.

● Do a management analysis of the company.

● Debt to Equity Ratio.

● Study about companies future plan.

● Company profit margin overview.

● See what the companies doing to expand itself.

Not Doing Technical Analysis of Chart

In this article of 10 mistakes of stock market, reading / investing in the market without any technical analysis comes second. When a person comes to the stock market for the first time he does not have any special knowledge about chart analysis. Due to this reason they have to suffer most of the losses. Fundamental analysis helps in telling which company you should invest in. But technical analysis does the work of telling at what price it is right to buy a company with good fundamentals.

How to Take Loan From Branch App Full Process Step By Step

Not Trusting Your Trading Strategy!

Not trusting your trading/investment strategy coms third in this list of 10 mistakes of the stock market. When a person comes to the stock market for the first time understand the basics of the stock market by doing fundamental and technical analysis. All traders work on their own strategy. But when traders are new they are not able to trust their trading strategy. For this reason they are not able to earn big profits even after using the right strategy.

Unable to Control Emotions

In this list of 10 mistakes of the stock market, not being able to control emotions comes at number 4. Investors and traders working in the stock market should never buy any share or trade on the basis of emotion there is no place for emotions in the stock market. When you keep looking at the stock chart continuously, then you start getting an idea of the next direction of the stock. This way you take the trade. It will since this type of your trade is not a trade but a gamble.

Best Passive Income Ideas Without Investment in India

Lack of Patience

In this list of 10 Mistakes of the stock market, lack of patience comes at number 5. Be it investing or trading in the stock market, patience is very important for both the participants. It is said that the stock market gives very fast returns but no one knows when the time will come. Therefore, after taking a trade that trader should wait until either the target or stop loss is hit.

Not admitting or Correcting Your Mistakes

In this list of 10 Mistakes of the stock market, it comes at number 6, Not admitting and not correcting one’s mistake. When a trader takes a trade and the trade goes in the wrong direction, they consider it to be a move by the operator, close the trade at a loss and move on to the next trade. Any stock or index usually gives some signal before a bullishness or recession.

Follow the Herd

Running behind the herd comes at number 7 in this list of 10 Mistakes of the stock market. The simple and clear meaning of not going in the herd is that when there is a recession in the market, everyone is selling their shares and there is selling all around in the market, then you should be greedy and buy shares. On the contrary, when the market is fast all the shares are going up rapidly. Everyone is buying shares, so you should not buy but enjoy the market boom.

How To Become Rich From The Share Market? 7 Golden Tips

Trying to Time the Market

Trying to time the market comes at number it in this list of 10 Mistakes of the stock market. What is actually true is that the stock market is a game of uncertainties. In this, no one can tell when a share will go up and when it will go down. The next move of the stock can be predicted only through technical analysis like candlestick patterns, support and resistance and stock market indicators.

Trader Not Setting Stop Loss

In this list of 10 stock market mistakes, traders’ failure to set stop loss comes at number 9. If you are an investor in the stock market then there is no need to set a stop loss. Because an investor does not buy shares for a day or two. An investor choses stock with good fundamentals and invests in the company for a long time. In such a situation when a stock with better fundamentals starts falling after buying, then the investors buy some more shares at the next support and bring down the average.

Using More Funds than the Fund

Using more funds than surplus funds comes at number 10 in this list of 10 Mistakes of the stock market. Traders/investors working in the stock market sometimes invest all their capital in the market, which is not right. You should invest only that capital in the stock market which you are not going to need for the next 3-4 years.

Summary

My dear readers, in today’s article 10 Mistakes of the Stock Market in English, we have learnt in detail about those major Mistakes of the stock market which a new trader often makes. Today will and what is the psychology of traders behind this mistakes which poses them to commit this mistakes we hope that now you have understood the 10 Mistakes of stock market in a better way.